virginia estimated tax payments due dates 2021

Virginia estimated tax payments due dates 2021 Wednesday June 22 2022 If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. This includes estimated extension and return payments.

Virginia estimated tax payments due dates 2021.

. Typically most people must file their tax return by May 1. If the ending month for the taxable year of the corporation is March 2021 enter 03 21. 11 2021 and up to june 15 2021 can now be paid on or before june 15 2021.

This form is for income earned in tax year 2021 with tax returns due in April 2022. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. 2020 Tax Return Dates Filed in 2021 Note that while many employer W2 investmentdividend 1099-MISC and unemployment tax forms are legally due on January 31st for this year the due date has been shifted to February 1st as Jan 31st is a Sunday.

Virginia estimated tax payments due dates 2021 Sunday. Icon suspension stages explained the curtis philadelphia address. Enter your Virginia account number the ending month and year for the entire taxable year calendar fiscal or short taxable year for which the estimated payment is made not the ending date for the quarter the estimated payment is made.

RICHMOND Governor Ralph Northam today announced that he is directing the Department of Taxation to extend the individual income tax filing and payment deadline in Virginia from Saturday May 1 2021 to Monday May 17 2021. We last updated the VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in January 2022 so this is the latest version of Form 760ES fully updated for tax year 2021. Estimated tax payments must be sent to the Virginia Department of Revenue on a quarterly basis.

- Virginia Tax is reminding taxpayers in Virginia if you havent yet filed your individual income taxes the filing and payment deadline is coming soon. Returns are due the 15th day of the 4th month after the close of your fiscal year. 5 Add Lines 2 and 5 and round to whole dollars.

You have until Monday May 2 2022 to submit your return. Virginias Individual Income Tax Filing and Payment Deadline is Monday May 2 2022 FOR IMMEDIATE RELEASE April 18 2022 RICHMOND Va. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15 2021 September 15 2021 and January 15 2022.

Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. Filing Extensions Cant file by the deadline.

Virginia Dpb Frequently Asked Questions

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Virginia State Taxes 2022 Tax Season Forbes Advisor

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

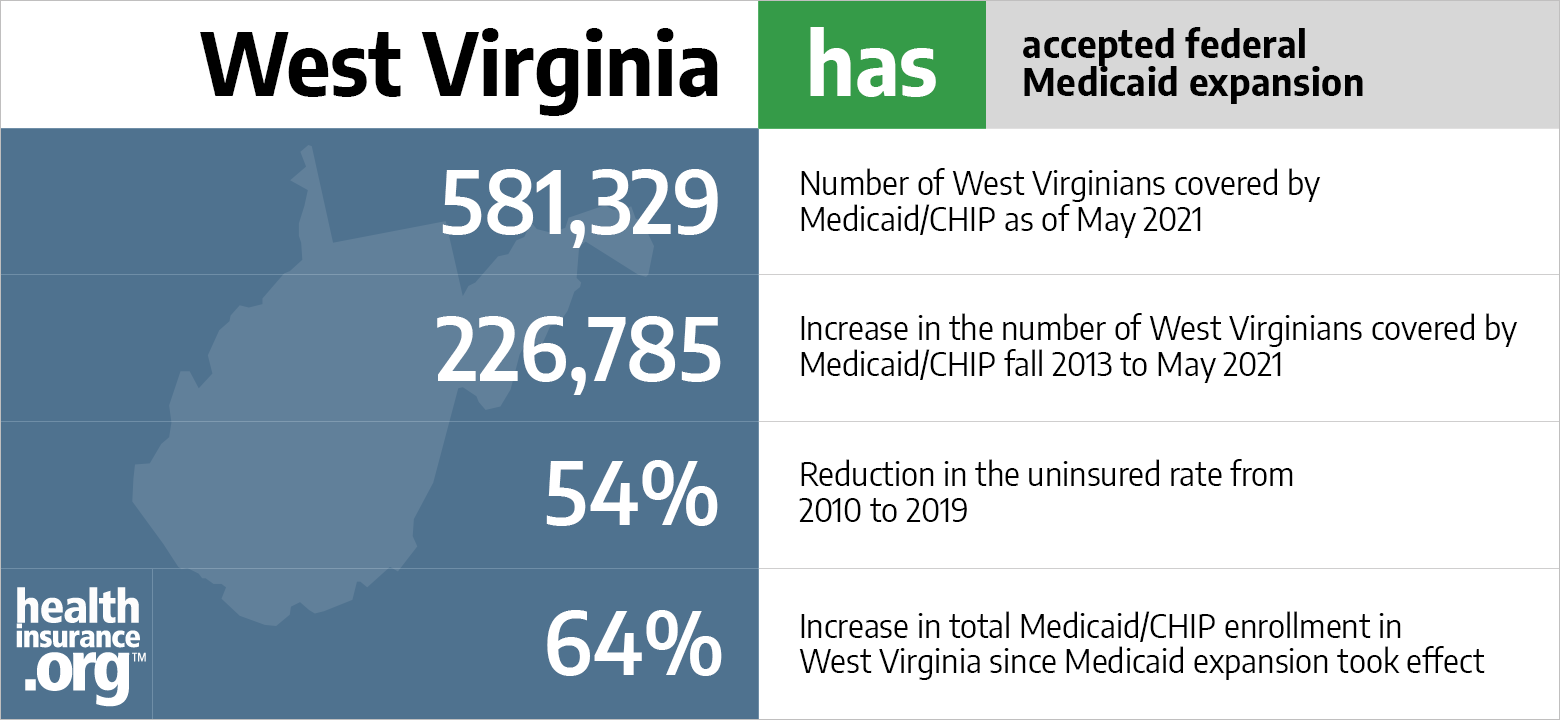

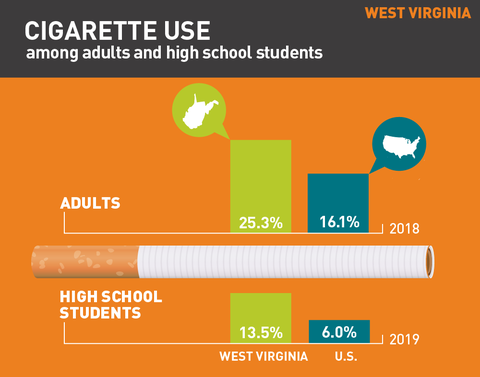

Aca Medicaid Expansion In West Virginia Updated 2022 Guide Healthinsurance Org

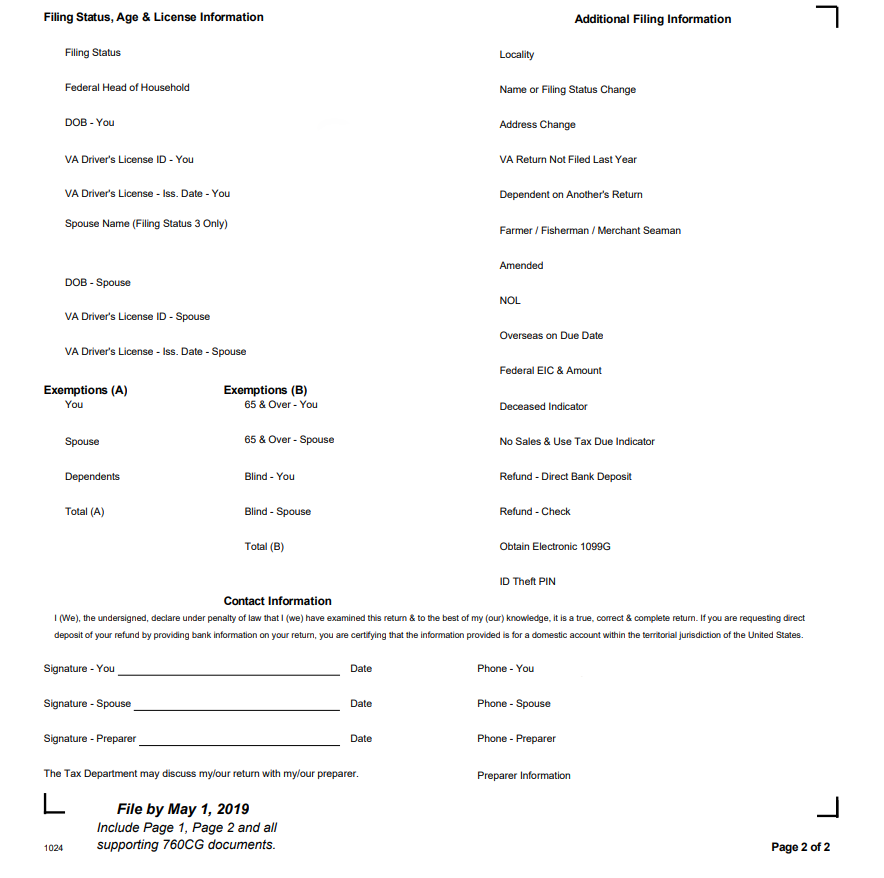

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Virginia Dpb Frequently Asked Questions

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Virginia Sales Tax Guide And Calculator 2022 Taxjar

Tobacco Use In West Virginia 2020

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Instructions On How To Prepare Your Virginia Tax Return Amendment